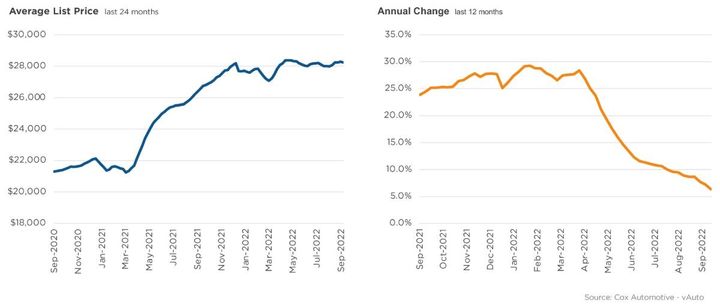

Price growth is slowing. The average listing rate for a used automobile was$ 28,237 at the end of September, up from the changed$ 28,064 at the end of August. That price is just$1,686, or 6%, in advance of a year ago.Graphic: Cox Automotive Used-vehicle stock as well as asking costs are maintaining while used supply held stable in September from August,

as well as is more than a year earlier, according to the Cox Automotive analysis of vAuto Available Inventory datav released Oct. 14. At the same time, growth in listing rates is slowing.The total supply of unsold secondhand cars on dealership lots, both franchised and also independent dealerships, across the U.S. stood at 2.46 million systems at the close of September, concerning the like the modified number at the end of August as well as 10% more than September 2021.

The overall days’ supply at the end of September stood at 50, compared to the changed 52 days’ supply at the end of August. Days’ supply in September was 8 days above year-ago degrees. Used-vehicle supply has been holding at concerning this level given that mid-January.

The Cox Automotive days’ supply is based upon the everyday sales price for the most current 30-day period, in this instance, finished Sept. 26. Sales were 1.48 million vehicles, compared to the modified 1.43 million at the end of August. For the month of September, Cox Automotive estimates utilized retail sales decreased 8% from August and also are down 10% from a year ago.The average listing cost for a used lorry was $28,237 at the end of September, up from the changed $28,064 at the end of August. That rate is just $1,686, or 6%, ahead of a year earlier.

“It may well be that higher interest rates are starting to hurt used-vehicle need due to the fact that customers can not pay for the higher regular monthly repayments,” stated Charlie Chesbrough, senior economist at Cox Automotive, in a news release. “Slowing sales and building inventory might compel dealerships to lower costs over the next couple of months.”

As with new autos, the lower the price, the tighter the inventory. The days’ supply enhances with every $10,000 boost in price category. Days’ supply for under $10,000 lorries is 33. At the contrary end of the range, days’ supply for automobiles over $35,000 is 65.

As with new lorries, Toyota, Subaru as well as Honda have the lowest days’ supply of secondhand vehicles at about 44.

Originally published on Vehicle Remarketing

For GREAT deals on a new or used Nissan check out O’Neil Nissan TODAY!